Things are starting to get serious, lily-bloom-wise speaking.

I got my Sword Master stickers from Lucania Arts!

https://www.etsy.com/shop/LucaniaArts

We study primarily Meyer in our group, so I put the Joachim Meyer sticker on the water bottle that I bring to practice:

But because I’m not particularly good at all the fancy stuff that Meyer teaches, I have a sneaking admiration for Johannes Liechtenauer, whose sword fighting instruction is accessible to any random peasant who happens to pick up a sword, so I put his sticker on my laptop:

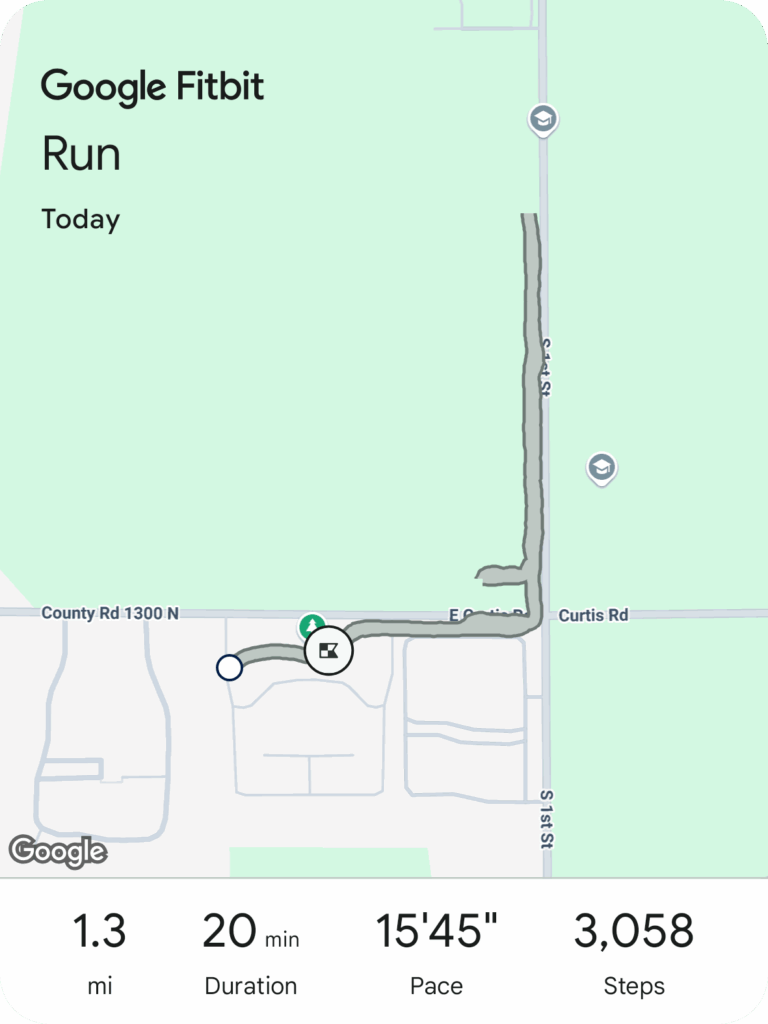

My run was already supposed to be pretty short—about 2.5 miles, across Dohme Park, up First Street to Windsor and then back—but it ended up being even shorter than that, because Ashley wasn’t up to running even that far in the heat of the day.

According to my weather app it was already 75℉ when I got home, and I’ve noticed previously that starting at about 72℉ the dog starts to suffer.

You can see on the map a short spur off to the west just after I started north on First Street. That was where we saw a groundhog, and Ashley really wanted to chase it. I indulged her for a minute, hoping the groundhog would quickly find a place to hide, but it wasn’t to be, and I eventually had to drag Ashley back to the First Street path very much against her will.

Anyway, 1.3 miles is a very short run indeed, but I still spent most of 20 minutes with my heart rate up (average was 141, peak was 169). So, a good workout.

I listened to an unintentionally amusing fitness video a few weeks ago. It was by a body-building guy, and was specifically on cutting weight after a bulk. (Topics that I’m not very interested in, but something to watch while I did my morning exercises.)

What was amusing was the discussion of what macronutrients to cut, when you need to reduce your calories.

Of course you can’t cut protein. That (along with resistance training) is key for keeping your muscle when you’re in a calorie deficit.

You can cut carbs—but not much! That’s what provides the energy you need to do your workouts! And your carbs were probably already low, if you were doing the low-carb thing.

You can cut fat—but not much! You need to get in your essential fatty acids! And your fats were probably already low, for general health reasons.

Now, I’ve gained a bit of weight over these past few years, and would be pleased to get back down to what I weighed in 2016–2021. But I’ve been hesitating to maintain any significant calorie deficit: I’ve reached an age where it’s pretty tough to put on more muscle, so any muscle I lose while dieting might well end up being a permanent loss—which is why I was interested enough to watch this video on the first place.

So, I was a bit daunted. If I can’t cut protein, carbs, or fat, how I am supposed to produce this calorie deficit anyway?

And then I remembered that there is a fourth macronutrient.

So, for a few days now, I’ve been both back on the low-carb thing (not so much for weight as because my nasal congestion has gotten bad again) and avoiding alcohol.

It’s very sad.

Along with avoiding alcohol for the calories, I’ve been keeping an eye on my sleep metrics. Nearly everybody with an Oura ring reports that drinking alcohol messes up their sleep, so I’ve been expecting to see a notable improvement, but so far not. Sleep score isn’t better. Sleep duration isn’t better. HRV isn’t better. My resting heart rate is down, but just because it had been elevated earlier—first when I had a cold, then when I had a guest.

I’ll give it another few days before drawing a conclusion, but I suspect the alcohol had not been negatively impacting my sleep because I never drank very much, and because I tended to finish drinking by fairly early in the evening, so I was pretty much sober by bedtime.

The good news is that the reduced carbs seem to be helping my nasal congestion already (although maybe it’s that the rain has washed a lot of the allergens out of the air).