Looked at properly, inflation is the money getting less valuable, which shows up as rising prices. It’s opposite, deflation, is the money getting more valuable, leading to falling prices. Something that used to be very obvious, but has perhaps become less so, is that inflation sucks if you have money, whereas deflation sucks if you owe money.

TL;DR version: You can reverse inflation, as long as you’re willing to grind into the dust everyone who owes money, making them work more and more, to earn less and less, to pay back debts that get higher and higher (because the dollars it takes to pay them off are getting more and more valuable). Society has done that many times in the past. Sometimes it works out okay; other times it produces terrible impoverishment of ordinary people, leading to social unrest.

The rest of this post looks at this in a bit more detail. I was prompted to write it because recent polls have suggested that young folks—Millennials and Gen-Z—continue to be unhappy about inflation, even though the inflation rate is down a lot. When you talk to these people, it turns out what they’re unhappy about is not inflation but rather prices: They remember what things used to cost, and they cost more than that now, which they find annoying, even if the price has largely quit going up. (And of course prices change all the time, so some prices are always going up.)

Older folk—people who lived through the inflation of the late 1970s and early 1980s—have a different perspective on that, partially because their parents and grandparents lived through the Great Depression.

Basically, they remember what happens when you try to push prices back down to what they were before a period of inflation.

There’s a sense among the “hard money” types that inflation is impossible when the currency is backed by gold, but this is false. There is often inflation under a gold standard, but it (often) ended up getting undone, meaning that looked at from the perspective of a century, it looks like there wasn’t much inflation. And indeed there wasn’t much inflation on average.

This was especially true during the heyday of the gold standard, roughly the 18th and 19th centuries. In 1816 the pound sterling was defined as 113 grains of pure gold, where it remained until 1931. (Before that it was defined as 5,400 grains of silver—about a pound of silver, hence the name a pound sterling—but in terms of value it was a similar amount of purchasing power.)

A big part of the reason that people remember the gold standard fondly is that it worked pretty well, especially for people who had money. With stable prices, it was even possible to value land not at a market price (because who would sell land?) but at the income that land would produce—an income that would remain stable for generations at a time.

However, as I said, there was still inflation. Inflation came from many sources, but two important ones: new discoveries of gold, and war. When the quantity of gold increased—as during the 1840s and 1850s when large amounts of gold were found in California and Australia—the rising quantity of gold (i.e. money) would produce inflation just like rising quantities of money produce inflation now. The other common source of inflation was war, because paying for a big war without inflation is almost impossible.

For example, there was a big inflation in the U.S. during the Civil War, when the Federal Government printed “greenbacks” to pay for the costs of the war. (The Confederates did the same, but as they lost the war their Confederate dollars ended up being worthless.) Dollars, on the other hand, were gradually revalued, with greenbacks gradually being withdrawn from circulation producing a grinding deflation that went on for more than a decade.

Like always in economics, there were other things going on at the same time. Industrialization was going on at the same time, meaning that things produced by industrial firms were getting cheaper, leading to deflation, while gold discoveries were leading to an increase in the supply of gold (= money) leading to inflation.

On balance there was deflation, meaning that people who had money were getting richer, while people who owed money were getting poorer. As long as that happens only in a small way, and as long as people sense that it’s “fair”—that nobody is cheating the system to take unfair advantage—it’s kinda nice. If you don’t owe money (and most people didn’t, because there were no credit cards, and virtually no student loans), then whatever meager savings you had got gradually more and more valuable. At the same time, wages tended not to drop (for the same reasons that wages tend not to drop these days as well), so somebody with a job ended up gradually better and better off.

Of course rich people got vastly more well off, so they loved it. The main people who hated it were farmers and small businessmen, because they generally needed to borrow money (to buy seed or raw materials), so they were constantly screwed by the fact that the money they had to pay back was worth more than the money they’d borrowed.

I started this post meaning to suggest that “kids these days” just didn’t understand the dynamics of deflation, But upon reflection, I think there’s another layer to it. Kids these days (as opposed to the Gen-X kids who trusted their parents and guidance counselors, and borrowed as much money as necessary to go to the best school they could get into) don’t owe so much money, so they’re not in the position of being utterly screwed by deflation. Many of them may be in the position of ordinary people in the great post-Civil War deflation, who ended up doing pretty well, with their wages or salary rising in value, while industrialization and globalization helps hold down prices.

The fact is, though, that deflation can absolutely destroy a generation of ordinary people. After WW I, for example, Britain, having funded the war through inflation, decided to return to the pre-war gold parity, which required a grinding deflation that lasted until 1929—great for people with money, bad for people without, devastating for people with debts. France decided instead to revalue, punishing people with money, coddling people with debts (which has its own downsides in terms of social disruption). German, the loser of WW I, saddled with debts denominated in gold, made a valiant effort to pay them back, giving up and starting WW II only when that proved utterly impossible.

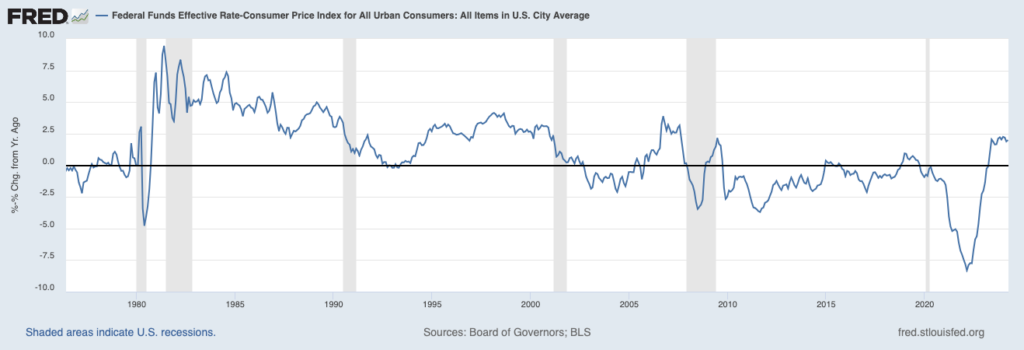

The lesson of that period, understood by pretty much everybody from the 1940s through the 2000s, was that the best thing to do after a period of inflation was to bring the inflation rate back down near zero, but accept the price increases that had already happened. (If the inflation rate is brought back down to, let’s say, 2%, prices will be generally stable. The slight remaining inflation will be barely noticeable, hidden amidst the ordinary rise and fall of prices due to changes in fashions, technological improvements in the means of production, depletion of resources, etc.)

It’s very interesting to see young folks returning to the instincts of the 18th and 19th century, thinking the prices should go back to what they were before the inflation. It goes very much against what I learned as an economics student, but who can say that what I learned was right and that their instincts are wrong?

Seems like a situation of “time will tell.”

Sources: