During the debt ceiling crisis back in 2011, I suggested that it would be no big deal if the government just “prioritized” spending so as to match revenues for however long it took Congress to get its act together and raise the debt ceiling. I got some push back on this by people who said I was crazy if I thought that much spending would suffice, but I never thought it would suffice—I was just sure that the result would be so onerous that Congress would knuckle under in no time. I figured that was what the Treasury secretly had in mind.

I’ve changed my mind.

It would have gone like this: The laws are contradictory—Congress sets the tax rates, Congress sets the spending levels, Congress sets the debt ceiling. The poor Treasury, simply doing the best it could in a no-win situation, would hold up pretty much all payments except interest on the debt, judges pay, soldiers pay, and social security. Once payments to major corporations in districts where recalcitrant Congressmen lived got held up, the stalemate would have ended pretty quickly.

I no longer think that’s what’s going to happen. Basically, I’ve come around the view that the Treasury meant what it said when it claimed that its hand were tied: It is legally required to spend the money the Congress has appropriated, whether the money is raised or not.

And I think there’s a solution.

Really, it’s the same solution as the “platinum coin” solution or the “issue scrip” solution, but those solutions are just gimmicks to put a pseudo-legalistic shine on what basically amounts to paying our bills by printing money.

I don’t think there’s any need for the gimmick. I think what the Treasury means to do once the headroom for keeping under the debt ceiling runs out is: Nothing. They’ll just go on writing checks exactly as they’ve been doing.

They’ll stop issuing new debt of course, so there’ll be no new money in their account at the Federal Reserve to pay the checks.

At which point, I’m reasonably sure, the Federal Reserve will just pay the checks anyway—which the Fed can easily do by just crediting the depositing bank’s account. (In other words, printing the money.)

Basically, the Fed would let the Treasury run an unlimited overdraft.

This works on several levels.

First of all, it doesn’t require any reprogramming or rejiggering of the Treasury’s numerous systems for making all the many payments they make every day. (No entity makes more payments than the US Treasury.) That’s good, because any attempt to do so would be problematic at best, and probably catastrophic in the short term.

Second, the people who are being most recalcitrant about raising the debt ceiling are the ones who would be most outraged. (I can just see them frothing at the mouth. Oh noes! Inflation!!1!)

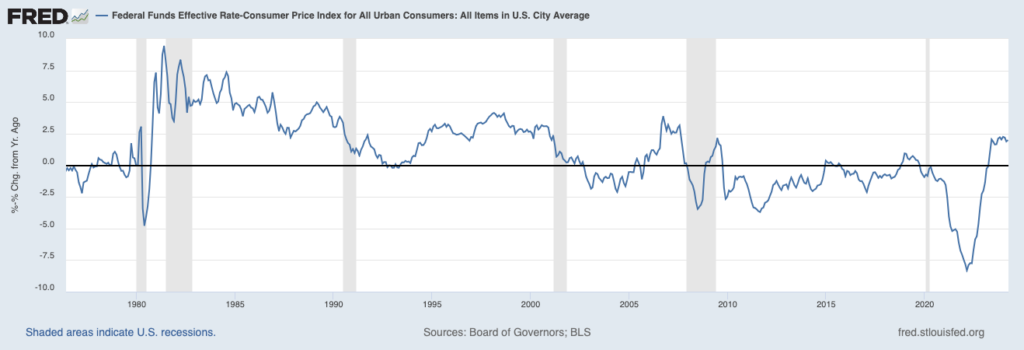

Third, under the current circumstances, it would probably be good for the economy. I’ve pretty much come around to Paul Krugman’s analysis that at the zero bound there is no inflation risk to printing money. Even better, if it did produce some inflation, that might get us up off the zero bound. (I for one would be very pleased to be able to earn a return on my capital.)

A generation ago the Fed would have hated this—bankers used to hate overdrafts in the deepest depths of their bowels. But overdrafts have been so profitable for banks these past 20 years or so, I expect we have a whole generation of bankers who have gotten over it.

As to whether it’s really legal or not, that’s something for the courts to decide. The debt ceiling applies to debt “subject to the limit.” The Fed and the Treasury will just say that, while an overdraft is debt, it’s not debt “subject to the limit.” The debt ceiling will be resolved long before any court case plays out.

The Treasury never admitted to having any contingency plans last time. Their take on it was that not raising the debt ceiling was unthinkable, therefore they would not think about it. But this is the only thing I can think of that could actually play out without chaos. If they weren’t planning on doing this (or something much like it), they’d have done something by now (such as having a dry run of their scheme for prioritizing payments).

Last time, I figured we’d get an 11th hour deal. This time, I think it’s pretty likely that the debt ceiling won’t get raised, and I think the Treasury will actually end up doing this—so I thought I’d share my thinking in case people find it useful.