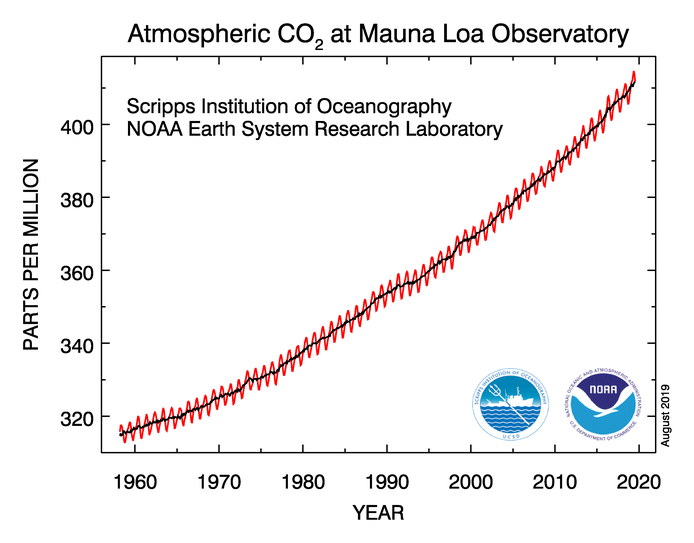

Interesting to me that the Great Recession doesn’t even show up as a blip on this graph.

Interesting to me that the Great Recession doesn’t even show up as a blip on this graph.

This sort of thing was a fantasy of mine, back in the 1980s. I could see things getting worse in the US, and the idea that a foreign passport and foreign residency could provide an escape if things got too bad was pretty appealing.

Nowadays not so much. It’s not that things have gotten better in the US; it’s that things have gotten worse other places at least as quickly. More to the point, things getting worse in the US seems to make things worse other places, so the conditions that make the idea appealing are the same conditions that make it pointless.

One book that substantially influenced my thinking in this area is Emergency: This book will save your life by Neil Strauss. I recommend it highly. In entertaining and informative prose, he documents his transformation from just the sort of kook I was in the 1980s into somebody with a much more practical perspective.

Still, an EU passport might have its upsides. Anybody got a spare quarter million euros and an interest in learning Greek? (If money is no object, a half million euros will let you buy in to Ireland, and I expect learning Gaelic is optional.)

Graphic from Citizenship for Sale on the International Monetary Fund’s IMFDirect blog.

One utterly predictable consequence of climate change is that the price of northern farmland will rise as growing regions shift north.

Tobias Buckell yesterday shared a report that just this sort of price shift is now occurring—interesting to me because this result is not merely predictable: I predicted it my own self, way back when I was in high school.

Global warming was still pretty speculative then (in the 1970s), but people were already talking about the greenhouse effect and trying to figure what the result would be. At the time, I was mainly thinking about the geopolitical implications of shifting the growing regions north—how things would change if Canada and the (then) Soviet Union were suddenly way more productive of food, while places like the United States, China, and France suddenly less so.

What I discovered, though, was that those northern regions aren’t nearly as fertile as places like Illinois, where 8,000 years of tall grass prairie left an incredibly thick layer of rich soil.

No matter how perfect the climate is, Saskatchewan is not going to produce the bushels per acre of Illinois or Kansas. Their soil is not only less fertile, it’s also much more fragile than the soil of the tall grass prairies. The fertile layer isn’t as deep, so the land must be plowed with greater care, and it will in any case be more quickly depleted.

I’m sure there’s a lot more and better data available now than there was back then, but I doubt if it changes the fundamentals. Shifting growing regions means winners and losers, but it also means less total food production.

One of the things I try to do in my fiction is show any collapse scenario as a process.

Your standard “if this goes on” story is all about looking ahead to see the result of current trends. But trying to see the endpoint of climate change, peak oil, habitat destruction, environmental degradation, or any similar process is going to be misleading. There is no endpoint—things keep going on.

I think the destruction wrought by Sandy is a good example. I’ve read a lot of stories set in a world where climate change has inundated the coasts. What aren’t nearly as common are stories set in the world we’re approaching: A world where the coasts are inundated only 1% of the time (or, a bit later, 2% of the time). A world where we see a 100-year storm every 8 or 10 years. A world where all our infrastructure spending is going for repairs, and yet we keep falling behind.

I say this is a world we’re approaching, but we may have already reached it. How many 100-year storms can you have in a decade before you have to admit that it’s not just a statistical anomaly, but rather is the new reality?

I’ve got a guest post up at Asta Lander’s blog Simply Living, about the trade-offs that people make when they choose to work for wages or a salary, and how you can get most of the benefits while avoiding most of the downside.

It’s called Choosing Freedom.

There was a time when most people were self-sufficient. They acquired what they needed through some mix of hunting, gathering, fishing, farming, raising animals, and making things themselves. Not many people do that any more.

There’s a whole genre of collapse-oriented investment writing. I’m something of a connoisseur of the form. But one really needs to treat that sort of literature as pornography—interesting to read, if you’re into that sort of thing, but almost nothing in it is stuff you’d actually want to do.

There are two ways most collapse writers go wrong. One is to assume that keen insight into the nature of the problems we face will allow one to make a bunch of smart investment moves in advance—as if there were some advantage to being the richest guy standing in a post-apocalyptic world.

In his recent post Where Should I Put My Money Before Things Collapse? John Robb avoids that trap pretty well. He understands that the systemic nature of the problem makes attempts to align your investments with the underlying trends pointless:

Looking for a safe asset class today, is like a Soviet bureaucrat in 1989, sensing trouble ahead, looking for the directorate with the safest job.

The other is to assume that there will be a collapse event. Those writers seem to suggest that you can spend your time until collapse behaving much as you do now (with some occasional time off to stock your shelter and practice your marksmanship), and then spend the end times hiding out in your shelter. That’s wrong, because there’s no reason to assume that there will be a collapse event. It’s at least as likely that things’ll go on much as they have been, with occasional points where a bunch of people lose their jobs, yet another class of investments suddenly becomes worthless, and various things (such as food or fuel) spike up in price.

John Robb does pretty well avoiding that trap as well. He understands that the only sensible response is to find a lifestyle that works now, and that will continue to work as collapse proceeds.

Just as he indicates, the right responses to problems like peak oil, peak debt, climate change, environmental degradation, habitat loss, and so forth are going to be community-level responses. With that in mind, he’s putting his money into supporting efforts to create that community response and those communities.

Having said all that, four decades of reading collapse literature have convinced me that collapse happens slowly. Very slowly. Slowly enough that we’re going to need to go on investing in ordinary investments for quite some time to come.

It seems like it would make sense to want those investments to be informed by the societal problems that we face, but my experience has been that an understanding of the sources of impending collapse doesn’t lead to useful investment insights.

There are a lot of reasons. First, as I said, collapse happens slowly, meaning that shorter-term trends will end up dominating. Second, a lot of governmental power will be brought to bear in support of pre-collapse norms, meaning the sort of large profits that might be produced if your investments do align with the large trends are prone to being seized or taxed away. Third, the situation is intractably complex, meaning that even a clear understanding of several of the problems may yield predictions that end up being trumped by other problems—no one can say whether peak debt or peak oil will influence the course of the economy more strongly or more suddenly.

The upshot is that investing for collapse is as pointless as Robb points out; I merely disagree with his analogy. Rather than being like a Soviet bureaucrat in 1989, I figure it’s more like being CEO of a department store chain in 1969. There are still opportunities to get ahead following the old arrangements, but all the most powerful forces of society, human nature, and nature itself are arrayed against you. You’d be much better off charting an entirely new course—and Robb’s suggestions are good ones.

I’ve already shared this on Google Reader (you can follow my shared items if you’re interested), but I wanted to blog it as well.

The always-interesting Dmitry Orlov is interviewed by Lindsay Curren in Transition Voice. As usual, Orlov is funny, but here he’s hitting on a lot of the same points that I like to hit on—that is, the points that I think are important—and is saying some really interesting stuff:

There’s this iron triangle of House-Car-Job, and the entire landscape is structured so you have to have all three or your life falls apart. People have to be creative in escaping from there.

He has a bit of advice (that I’m living right now): Retire immediately.

. . . make what ever adjustments are needed considering that you’re not going to have much of an income. Have a little bit of an income. But get rid of the mortgage, obviously. Get rid of the car.

He suggests that you shirk off for a couple of years and see where that takes you, then go back to work and earn enough to support the kind of lifestyle that you’ve already adjusted to.

A lot of people have, of necessity, already done this. But a lot have taken the opposite tack: they have abandoned any hope of every retiring. With their retirement savings destroyed and their kids unable to support themselves, they’re figuring that they’re going to have to keep working for years—maybe a decade or more—past what used to be retirement age. But that’s a crappy strategy. (For many reasons, but especially because it may well not be possible. There’s a good chance that your job will go away, even if it seems secure now. And there’s a good chance that your health won’t allow you to maintain your current pace, even if it’s holding up pretty well so far.) Orlov’s suggestion is a much better idea.

Check out the whole interview: No shirt, no shoes, no problem.

People are bad at comparing risks, and people like to point this out by making comparisons to risks that people tolerate on a daily basis. For example, pointing out that many more people die in car accidents than are killed by terrorists, or pointing out that providing electricity by burning coal kills and injures more people than providing electricity by fissioning uranium.

At one level, I find these arguments compelling. I find it preposterous that we spend so much money on homeland security. That money would be much better spent (in terms of lives saved per dollar) on traffic safety, or probably a lot of other things. I gather, based on the fact that people keep pointing this out without producing any visible change in funding priorities, that most people don’t find this a compelling argument.

I’ve always wondered about that, and perhaps I’ve figured out why in the “coal versus nuclear” argument, which I don’t find compelling.

Plenty of people die to provide us with power from coal. Miners die from accidents. People die in road accidents moving coal from the mine to the power plant. Workers die in ordinary industrial accidents at power plants. People die from respiratory problems caused by or exacerbated by pollution from burning coal. People die in severe weather—which is becoming more common, probably because of global warming.

Except for that last, this is our baseline status. We know the costs and risks, and we accept them. Some people work to improve things—better mine safety, better level crossings for trains, lower emissions from coal burning—but the baseline is accepted. Importantly, an individual can do a lot to reduce his or her risk, such as by not making a career in coal mining, by exercising due care at rail crossings, and by living some place with clean air (and not smoking).

With nuclear power, things are different. The baseline status is safer. Deaths in uranium mining are very small, because the volume of uranium ore needed is so small compared to the volume of coal. Deaths from industrial accidents are small, because the number of workers is small (and, perhaps, because some additional attention is paid to safety at a nuclear plant for reasons having to do with greater regulation and particular concerns about public perceptions of safety). Deaths caused by the release of radiation are very, very small, because we go to vast effort and expense to avoid them.

But although the baseline status is relatively safe, the contingent risks are huge. The problems that led to the catastrophe we’re seeing now at the Fukushima Daiichi plants are replicated all over the world. It’s not just plants built on fault lines and plants built places where tsunamis can occur. It’s things like redundant safety systems that aren’t really redundant. Most especially, it’s committing to providing active safety over a period that’s much longer than human institutions reliably persist.

On the former issue, I have an oddly relevant memory. As a boy I attended public hearings in Kalamazoo on the licensing of the nuclear power plant at Palisades. At one hearing, a lawyer opposing licensing pointed out that a line carrying backup power for the plant ran through the same conduit as a line carrying the regular power. In some clever showmanship, he snapped a pencil in two to illustrate the fact that this produced a common point of failure. Learning that the backup generators at Fukushima were in basements where they would be lost in a tsunami produced an odd echo of that memory.

The latter issue is really more to the point. We are relying on corporations to actively manage the safety of these plants and the spent fuel—corporations that will cease to exist if the cost of this management burden ever grows to the point that it consumes the corporation’s profits.

I think the degree to which these safety issues needed to be actively managed has surprised a lot of people. I’ve many times heard people suggest that managing nuclear waste was no big deal—just put the stuff in a concrete vault and put a fence around it with signs saying “If you come in here you’ll probably die.” I always knew that was dumb, but I was mostly worried about people deliberately coming in to use the waste to make dirty bombs and the like. I didn’t quite realize to what an extent the spent fuel rods depended on a whole complex system of cooling equipment to keep them from bursting into flame and spreading radioactive smoke and steam wherever the wind blew.

So that, I think, is why we accept coal power and think of nuclear as dangerous. We could give up coal power anytime we, as a society, decided that the cost was too high. If we were willing to cut way back on air conditioning, electric lighting, and all the other things we run with electricity, we could just quit the whole thing. The only dangers left behind would be some moderately dangerous holes in the ground, some toxic heaps of ash, and the pollutants that are already in the air. With nuclear power that’s very much not true. We could give up nuclear power today and we’d be on the hook for decades of active management of the high-level waste and generations of (mostly passive) management of the low-level waste.

I think maybe the issue with risks from terrorism is the same. People know what the trade-offs are for driving. If we, as a society, decided to give up driving, we could cut deaths from road accidents almost to zero. But terrorism isn’t like that. There’s nothing we could give up to prevent terrorism, and the contingent risks are huge. An endless stream of terrorist acts that killed tens, hundreds, or thousands of people seems very different from the many other activities that we engage in that cost tens, hundreds, or thousands of lives.

It’s a bummer about nuclear power, though. It would be cool if a network of high-speed electric trains could provide transportation in a post-peak oil world, and I’d begun to think it might be a reasonable alternative. A mere twenty-five years with no major nuclear accidents was enough to make nuclear power start seeming pretty safe again. This is a good reminder that it really isn’t—and that we need to think carefully about the difference between accepting risks for ourselves now, and accepting risks for everyone stretching off into the future.

[Update 2011-03-23: There’s a lot of misinformation about whether very low doses of radiation are harmful. Here’s a paper with a survey of what we actually know about the effects of low doses of ionizing radiation (from the Proceedings of the National Academy of Sciences).]

[This article originally appeared as a guest post on Self Reliance Exchange, but that site no longer exists and the successor site doesn’t seem to be using my post. Rather than just let the article disappear, I figured I’d post it here.]

There’s a reason we don’t see more self-sufficiency: It’s not frugal. It almost always takes more time to make something than it takes to earn enough money to buy one—and that’s without even considering the time it takes to learn the skills (let alone the cost of tools and materials). On the other hand, frugality is a powerful enabler for self-sufficiency. So, how do you find the sweet spot?

My wife spins and weaves. I have a beautiful sweater that she hand knit from hand spun yarn. It’s wonderful—and it’s comforting to know that my household is not only self-sufficient in woolens, we produce a surplus that we can sell or trade. But the fact is you can buy a perfectly good sweater at Wal-Mart for less than the cost of the yarn to knit it.

If you try to be genuinely self-sufficient—in the sense of producing through your own labor everything your household uses, like a hunter-gatherer or a subsistence farmer—you’re going to be poor. Your neighbor who works at a job for wages or a salary is going to be better off by almost every measure.

Oh, his factory-made microwave meals won’t be as good as home-cooked food from your garden and his furniture from Ikea won’t be as good as what you make in your wood shop. But he’ll have so much more! In the time it takes you just to build a kiln he’ll earn enough money to buy a thirty piece set of Corelle ware. Unless he’s only making minimum wage, he’ll probably have enough left over to buy an iPod—and you’ll never be able to make your own iPod from sand and vegetable oil.

That’s why we have trade. If everybody specializes in one or a few things, and then trades with others for what they need, everybody can be better off. It raises your standard of living, but it means that you can’t be self-sufficient.

There are still many reasons to do for yourself. You can make exactly what you want, instead of having to make do with whatever happens to be available on the market. You can use superior materials, and take them from the environment in a sustainable manner. You don’t have to worry that the stuff you use was made in a sweatshop by children or prisoners or slaves. You aren’t dependent on the continued smooth functioning of the vast global economy. But you can’t be self-sufficient in very many things—even if you had the skills and the tools and the land, you’d quickly run out of time.

So, we find ourselves trying to figure out where we belong on the continuum between actual self-sufficiency and ordinary self-reliance. How do you find the sweet spot? Here are my thoughts:

Start with the few things where homemade actually is cheaper, like gardening. Then move on to things that can be done as a hobby—and that you’d enjoy doing as a hobby. Don’t let point #1 above (necessities) keep you from developing self-sufficiency in something that’s fun and interesting just because it’s not important. It may not be important to be self-sufficient in beer, but the equipment is cheap, brewing is a pretty easy skill to acquire, and the result is better than what you can buy.

Finally, remember that there’s a vast range between being “self” sufficient and being dependent on a global supply chain. It’s almost as good as self-sufficiency to source things from your neighbors. Short of that, it’s still an improvement to source things closer rather than farther—your home town, your region, your state, your country.

Once you set your priorities, don’t hesitate to go with the cheapest option for things that don’t make the cut. That frees up money that you can use on the important underpinnings of self-sufficiency—things like land and tools in particular, but also things like books, training classes, materials to practice with, and so on.

Then you’re in your sweet spot.

Via Dmitry Orlov, I happened upon America: The Grim Truth, which I think is worth reading, even though I disagree with both the forecast and the prescription.

It’s worth reading because I think it’s actually pretty good descriptively—it nails the split between the reality of the current situation and the average American’s perception of it. I am persistently amazed at the things that Americans just accept.

On food:

Much of the beef you eat has been exposed to fecal matter in processing. Your chicken is contaminated with salmonella. Your stock animals and poultry are pumped full of growth hormones and antibiotics.

On education:

In most countries in the developed world, higher education is either free or heavily subsidized; in the United States, a university degree can set you back over US$100,000. Thus, you enter the working world with a crushing debt. Forget about taking a year off to travel the world and find yourself – you’ve got to start working or watch your credit rating plummet.

On wealth:

America has the illusion of great wealth because there’s a lot of “stuff” around, but who really owns it? In real terms, the average American is poorer than the poorest ghetto dweller in Manila, because at least they have no debts. If they want to pack up and leave, they can; if you want to leave, you can’t, because you’ve got debts to pay.

On freedom:

Why would anyone put up with this? Ask any American and you’ll get the same answer: because America is the freest country on earth. If you believe this, I’ve got some more bad news for you: America is actually among the least free countries on earth. Your piss is tested, your emails and phone calls are monitored, your medical records are gathered, and you are never more than one stray comment away from writhing on the ground with two Taser prongs in your ass.

Even though I agree with just about all of that, I disagree on the prospects for the future.

First of all, the current situation is still an improvement over most of US history. Through our whole first century and a half, the average American lived a life just as dangerous, just as precarious, and just as vulnerable as the one described above. And if the average American didn’t owe just as much money, it was only because he didn’t have access to that much credit.

My point is not that things are okay now, but rather that the fact that things got better serves as an existence proof that getting better is something that can happen.

Second, although the situation in the US is very bad for someone who has gotten caught in the wage-slave/debt-slave trap, it remains possible in the US to opt out. It’s actually pretty easy, as long as you avoid debt. And avoiding debt is pretty easy: just don’t let yourself be sucked into the consumer lifestyle. There’s an awful lot of crap for sale—don’t buy it. There are plenty of big houses for sale—don’t buy one. You can live in a bigger, nicer apartment if you’re willing to live an hour’s drive from where you work—but if you live where you can walk to work, you don’t have to buy a car. With the money you save, join the rentier class.

I think we ought to change things, and I think it would be great if we could get the government to set rules that would encourage those changes—require uncontaminated food, prohibit predatory lending, protect workers from abuse, etc. But individuals can actually make those changes in their own lives without needing the government to act.

So I don’t see a need to flee the country. But that doesn’t mean that I think things are okay—which is why I think that’s a post worth reading.