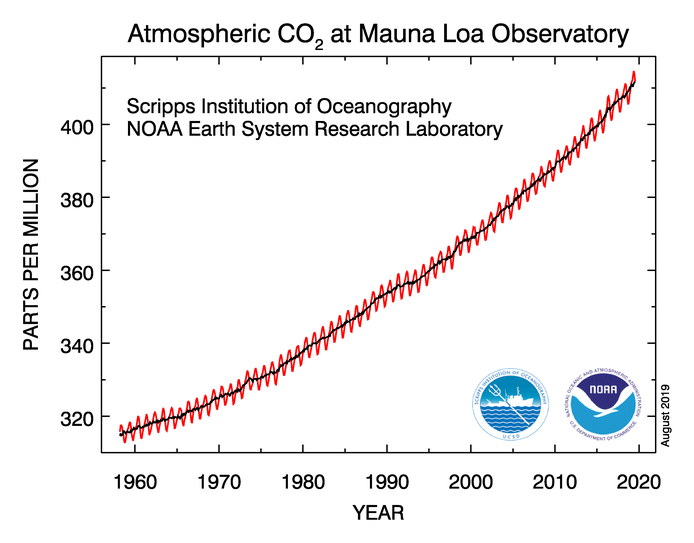

Interesting to me that the Great Recession doesn’t even show up as a blip on this graph.

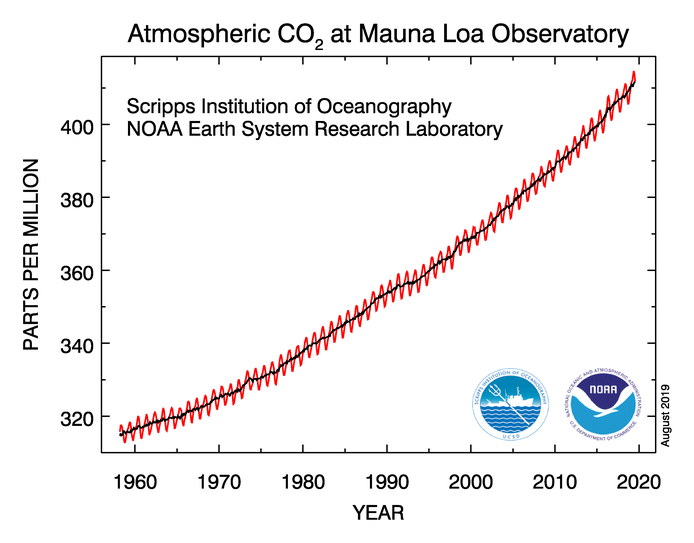

Interesting to me that the Great Recession doesn’t even show up as a blip on this graph.

There’s a whole genre of collapse-oriented investment writing. I’m something of a connoisseur of the form. But one really needs to treat that sort of literature as pornography—interesting to read, if you’re into that sort of thing, but almost nothing in it is stuff you’d actually want to do.

There are two ways most collapse writers go wrong. One is to assume that keen insight into the nature of the problems we face will allow one to make a bunch of smart investment moves in advance—as if there were some advantage to being the richest guy standing in a post-apocalyptic world.

In his recent post Where Should I Put My Money Before Things Collapse? John Robb avoids that trap pretty well. He understands that the systemic nature of the problem makes attempts to align your investments with the underlying trends pointless:

Looking for a safe asset class today, is like a Soviet bureaucrat in 1989, sensing trouble ahead, looking for the directorate with the safest job.

The other is to assume that there will be a collapse event. Those writers seem to suggest that you can spend your time until collapse behaving much as you do now (with some occasional time off to stock your shelter and practice your marksmanship), and then spend the end times hiding out in your shelter. That’s wrong, because there’s no reason to assume that there will be a collapse event. It’s at least as likely that things’ll go on much as they have been, with occasional points where a bunch of people lose their jobs, yet another class of investments suddenly becomes worthless, and various things (such as food or fuel) spike up in price.

John Robb does pretty well avoiding that trap as well. He understands that the only sensible response is to find a lifestyle that works now, and that will continue to work as collapse proceeds.

Just as he indicates, the right responses to problems like peak oil, peak debt, climate change, environmental degradation, habitat loss, and so forth are going to be community-level responses. With that in mind, he’s putting his money into supporting efforts to create that community response and those communities.

Having said all that, four decades of reading collapse literature have convinced me that collapse happens slowly. Very slowly. Slowly enough that we’re going to need to go on investing in ordinary investments for quite some time to come.

It seems like it would make sense to want those investments to be informed by the societal problems that we face, but my experience has been that an understanding of the sources of impending collapse doesn’t lead to useful investment insights.

There are a lot of reasons. First, as I said, collapse happens slowly, meaning that shorter-term trends will end up dominating. Second, a lot of governmental power will be brought to bear in support of pre-collapse norms, meaning the sort of large profits that might be produced if your investments do align with the large trends are prone to being seized or taxed away. Third, the situation is intractably complex, meaning that even a clear understanding of several of the problems may yield predictions that end up being trumped by other problems—no one can say whether peak debt or peak oil will influence the course of the economy more strongly or more suddenly.

The upshot is that investing for collapse is as pointless as Robb points out; I merely disagree with his analogy. Rather than being like a Soviet bureaucrat in 1989, I figure it’s more like being CEO of a department store chain in 1969. There are still opportunities to get ahead following the old arrangements, but all the most powerful forces of society, human nature, and nature itself are arrayed against you. You’d be much better off charting an entirely new course—and Robb’s suggestions are good ones.

I’ve already shared this on Google Reader (you can follow my shared items if you’re interested), but I wanted to blog it as well.

The always-interesting Dmitry Orlov is interviewed by Lindsay Curren in Transition Voice. As usual, Orlov is funny, but here he’s hitting on a lot of the same points that I like to hit on—that is, the points that I think are important—and is saying some really interesting stuff:

There’s this iron triangle of House-Car-Job, and the entire landscape is structured so you have to have all three or your life falls apart. People have to be creative in escaping from there.

He has a bit of advice (that I’m living right now): Retire immediately.

. . . make what ever adjustments are needed considering that you’re not going to have much of an income. Have a little bit of an income. But get rid of the mortgage, obviously. Get rid of the car.

He suggests that you shirk off for a couple of years and see where that takes you, then go back to work and earn enough to support the kind of lifestyle that you’ve already adjusted to.

A lot of people have, of necessity, already done this. But a lot have taken the opposite tack: they have abandoned any hope of every retiring. With their retirement savings destroyed and their kids unable to support themselves, they’re figuring that they’re going to have to keep working for years—maybe a decade or more—past what used to be retirement age. But that’s a crappy strategy. (For many reasons, but especially because it may well not be possible. There’s a good chance that your job will go away, even if it seems secure now. And there’s a good chance that your health won’t allow you to maintain your current pace, even if it’s holding up pretty well so far.) Orlov’s suggestion is a much better idea.

Check out the whole interview: No shirt, no shoes, no problem.

In 2008 I posted Ron’s paper on Peak Debt. He recently extended his work, in a new paper called Peak Debt and Income.

Once again, I’ve got a piece up at Wise Bread that provides an overview of paper:

Laszewski creates a simple model of the economy as a tool for investigating the question of how to get household balance sheets back in order after suffering the problems diagnosed in the earlier Peak Debt paper…

Really, though, you ought to read the paper. (The math in this one isn’t as tricky as the math in the original Peak Debt paper.)

Via Dmitry Orlov, I happened upon America: The Grim Truth, which I think is worth reading, even though I disagree with both the forecast and the prescription.

It’s worth reading because I think it’s actually pretty good descriptively—it nails the split between the reality of the current situation and the average American’s perception of it. I am persistently amazed at the things that Americans just accept.

On food:

Much of the beef you eat has been exposed to fecal matter in processing. Your chicken is contaminated with salmonella. Your stock animals and poultry are pumped full of growth hormones and antibiotics.

On education:

In most countries in the developed world, higher education is either free or heavily subsidized; in the United States, a university degree can set you back over US$100,000. Thus, you enter the working world with a crushing debt. Forget about taking a year off to travel the world and find yourself – you’ve got to start working or watch your credit rating plummet.

On wealth:

America has the illusion of great wealth because there’s a lot of “stuff” around, but who really owns it? In real terms, the average American is poorer than the poorest ghetto dweller in Manila, because at least they have no debts. If they want to pack up and leave, they can; if you want to leave, you can’t, because you’ve got debts to pay.

On freedom:

Why would anyone put up with this? Ask any American and you’ll get the same answer: because America is the freest country on earth. If you believe this, I’ve got some more bad news for you: America is actually among the least free countries on earth. Your piss is tested, your emails and phone calls are monitored, your medical records are gathered, and you are never more than one stray comment away from writhing on the ground with two Taser prongs in your ass.

Even though I agree with just about all of that, I disagree on the prospects for the future.

First of all, the current situation is still an improvement over most of US history. Through our whole first century and a half, the average American lived a life just as dangerous, just as precarious, and just as vulnerable as the one described above. And if the average American didn’t owe just as much money, it was only because he didn’t have access to that much credit.

My point is not that things are okay now, but rather that the fact that things got better serves as an existence proof that getting better is something that can happen.

Second, although the situation in the US is very bad for someone who has gotten caught in the wage-slave/debt-slave trap, it remains possible in the US to opt out. It’s actually pretty easy, as long as you avoid debt. And avoiding debt is pretty easy: just don’t let yourself be sucked into the consumer lifestyle. There’s an awful lot of crap for sale—don’t buy it. There are plenty of big houses for sale—don’t buy one. You can live in a bigger, nicer apartment if you’re willing to live an hour’s drive from where you work—but if you live where you can walk to work, you don’t have to buy a car. With the money you save, join the rentier class.

I think we ought to change things, and I think it would be great if we could get the government to set rules that would encourage those changes—require uncontaminated food, prohibit predatory lending, protect workers from abuse, etc. But individuals can actually make those changes in their own lives without needing the government to act.

So I don’t see a need to flee the country. But that doesn’t mean that I think things are okay—which is why I think that’s a post worth reading.

In his article Saving Yourself [Note: article is now behind a paywall] Daniel Akst buries at the end a particularly good statement of the central point I try to make in my personal finance writing:

Thrift is thus a way to redeem yourself not just from the unsexy bondage of indebtedness but also from subjugation to people and efforts that are meaningless to you, or worse. Debt means staying in a pointless job, failing to support needy people or worthwhile causes, accepting the strings that come with dependence, and gritting your teeth when your boss asks you to do something unethical instead of saying “drop dead”. Ultimately, thrift delivers not just freedom but salvation—which makes it a bargain even Jack Benny could love.

To get there, though, he takes you on a wonderful journey through the American history of thrift, from Jack Benny to the Puritans and back again, with a couple of side trips to Sexyland.

Ron has kindly let me host his fascinating peak debt paper on my site.

I take a quick look at the paper in my Wise Bread post on Peak Debt:

Is there a limit to how much Americans can spend? Clearly there is: All they earn, minus savings and service on their existing debt, plus new borrowing. Since the Bureau of Economic Analysis puts numbers on those very items, it’s possible to see just how close we are to the edge. In a fascinating paper, Ron Laszewski does exactly that. The results are rather depressing.

Whether you read my Wise Bread piece or not, if you can follow the math, I urge you to read Ron’s paper itself: peak-debt-pd-020708.